The price channel is a technical analysis tool used by traders to identify trends and potential buy or sell signals. It is a useful tool for identifying points of support and resistance in a market and can be used to help traders make informed decisions about when to buy or sell a particular asset. In this guide, we will explore what the price channel is, the different types of price channels, how to read a price channel chart, the pros, and cons of using the price channel, and provide examples of trading strategies using the price channel.

You can also read: The Silent Danger of Replay Attacks(What You Need to Know?)

What is the Price Channel?

The price channel is a technical analysis tool that is used to identify trends in the market. It is created by drawing two parallel lines on a price chart, with one line representing the upper limit of the price movement and the other line representing the lower limit of the price movement. These lines are drawn based on the highest and lowest prices reached by the asset over a certain period of time.

The upper line of the channel is referred to as the resistance line, while the lower line is referred to as the support line. These lines are used to identify potential buying and selling opportunities, as they can help traders identify when the price of an asset is likely to break out of the channel and move in a new direction.

Types of Price Channels

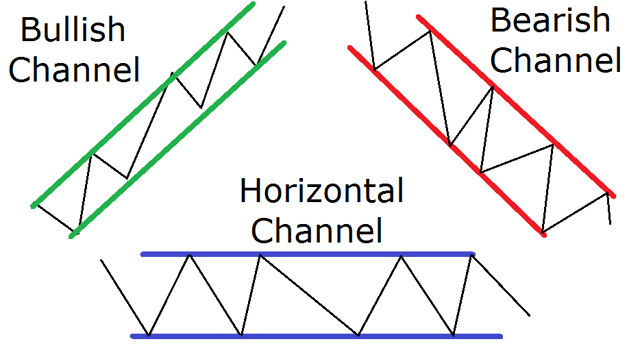

There are three main types of price channels: the ascending channel, the descending channel, and the horizontal channel.

1. Ascending Channel

An ascending channel is formed when the price of an asset is consistently making higher highs and higher lows. In other words, the support line is sloping upwards, while the resistance line is also sloping upwards. This indicates that the asset is in an uptrend, and traders may look for buying opportunities when the price touches the support line.

2. Descending Channel

A descending channel is formed when the price of an asset is consistently making lower highs and lower lows. In other words, the resistance line is sloping downwards, while the support line is also sloping downwards. This indicates that the asset is in a downtrend, and traders may look for selling opportunities when the price touches the resistance line.

3. Horizontal Channel

A horizontal channel is formed when the price of an asset is moving sideways, with no clear trend in either direction. In this case, the support and resistance lines are horizontal and may be used to identify potential buying and selling opportunities when the price reaches either line.

How to Read a Price Channel Chart?

To read a price channel chart, you should first identify the two parallel lines that make up the channel. The resistance line represents the upper limit of the price movement, while the support line represents the lower limit of the price movement. These lines can be used to identify potential buying and selling opportunities, as well as to identify points of support and resistance in the market.

Traders may also use other technical indicators, such as moving averages, to confirm signals provided by the price channel. For example, if the price of an asset is touching the support line of an ascending channel and the 50-day moving average is also trending upwards, this may provide a stronger signal that the asset is in an uptrend and may be a good buying opportunity.

Pros and Cons of the Price Channel

While the price channel can be a useful tool for identifying trends and potential buying and selling opportunities in the market, traders should be aware of its limitations and use it in conjunction with other technical and fundamental analysis tools to make well-informed trading decisions.

Pros:

- Identifies Trends: A price channel is a useful tool for identifying trends in the market, which can help traders make informed decisions about when to buy or sell an asset.

- Provides Support and Resistance Levels: The support and resistance lines of the price channel can be used to identify potential points of support and resistance in the market, which can help traders make better decisions about when to enter or exit a trade.

- Easy to Use: The price channel is a simple tool that is easy to use and can be applied to a wide range of markets and assets.

- Provides Clear Entry and Exit Signals: The price channel can provide clear entry and exit signals for traders, making it easier to determine when to enter or exit a trade.

- Helps Manage Risk: By identifying support and resistance levels, the price channel can help traders manage risk by setting stop-loss orders at key levels.

Cons:

- False Signals: Like all technical analysis tools, the price channel is not infallible and can provide false signals, which can lead to losses for traders.

- Lagging Indicator: The price channel is a lagging indicator, which means that it may not provide signals until after a trend has already begun. This can result in missed opportunities or entering a trade too late.

- Limited Information: The price channel only provides information about the price movement of an asset, and does not take into account other factors that may influence the market, such as news events or economic data. This can make it difficult to make well-informed trading decisions based solely on the price channel.

- Can be Subjective: The process of drawing the support and resistance lines for a price channel can be subjective, which means that different traders may draw the lines differently and come up with different signals.

- May Not Work in All Markets: The price channel may not work as well in all markets or for all assets, as some markets or assets may not exhibit clear trends or may be too volatile for the price channel to be a reliable indicator.

Examples of Trading Strategies using the Price Channel

- Breakout Trading: Breakout trading is a popular strategy that involves buying an asset when it breaks out of a price channel. For example, if the price of an asset has been moving within a horizontal channel and then breaks out above the resistance line, this may be a signal to buy the asset.

- Trend-Following: Trend-following is a strategy that involves buying an asset when it is in an uptrend or selling an asset when it is in a downtrend. Traders may use the support and resistance lines of the price channel to identify trend direction and potential buying or selling opportunities.

- Mean Reversion: Mean reversion is a strategy that involves buying an asset when it is oversold and selling it when it is overbought. Traders may use the support and resistance lines of the price channel to identify when an asset is trading at an extreme level and may be due for a reversal.

What are some examples of markets or assets where the price channel may not work well?

While the price channel can be a useful tool for many markets and assets, there are some cases where it may not be as effective. Here are some examples:

- Highly volatile markets: The price channel may not work well in markets that are highly volatile, such as cryptocurrencies or penny stocks. These markets can experience rapid price movements that can make it difficult to draw accurate support and resistance lines.

- Illiquid markets: The price channel may not work well in illiquid markets, such as some small-cap stocks or thinly traded currency pairs. In these markets, there may be limited price data available, making it difficult to draw accurate support and resistance lines.

- News-driven markets: The price channel may not work well in markets that are heavily influenced by news events or economic data releases. In these markets, sudden news events can cause rapid price movements that can break through support or resistance levels, rendering the price channel less effective.

- Range-bound markets: The price channel is designed to work best in trending markets where the price is moving in a clear direction. In range-bound markets, where the price is moving sideways, the price channel may not be as effective as other technical analysis tools, such as oscillators or Bollinger Bands.

- Assets with low trading volume: The price channel may not work well for assets with low trading volumes, such as some small-cap stocks or exotic currency pairs. In these markets, there may be limited price data available, making it difficult to draw accurate support and resistance lines.

It’s important to note that the effectiveness of the price channel can vary depending on the specific market or asset being analyzed. Traders should always conduct a thorough analysis and use multiple technical analysis tools to confirm signals before making any trading decisions.

In conclusion

The price channel is a useful tool for identifying trends and potential buying and selling opportunities in the market. By drawing two parallel lines on a price chart, traders can identify potential points of support and resistance and make informed decisions about when to enter or exit a trade. While the price channel is not infallible and can provide false signals, it is a simple and easy-to-use tool that can be applied to a wide range of markets and assets. Traders may use the price channel in combination with other technical indicators to confirm signals and improve their trading results.