The stock market is an important part of today’s financial world because it makes it easier to buy and sell shares. But for newbies, it can be hard to figure out how the market works. This complete guide is meant to take the mystery out of the stock market by explaining how it works.

What Is the Stock Market?

Different places where people can buy and sell shares of publicly traded companies are called “stock markets.” These kinds of financial transactions happen on official exchanges and over-the-counter (OTC) markets that follow a clear set of rules.

People often use “stock market” and “stock exchange” to mean the same thing. Stock market traders buy and sell shares on one or more of the stock platforms that make up the stock market as a whole.

Stock Market: How the Market Works?

By selling shares of stock, the stock market assists businesses in raising capital to run their operations and makes and keeps buyers wealthy.

Companies raise funds by selling stock to investors. Shares of a firm are called stock. Companies can grow without borrowing by selling shares on stock markets. To sell stock, companies must communicate information and enable owners participate in business management.

Investors profit from stock purchases. Businesses expand with the money. Capital gains help investors by increasing the value of their stock. Business owners receive dividends when profits rise. Individual stocks perform differently, but the stock market as a whole has averaged 10% annual returns, making it one of the safest ways to invest.

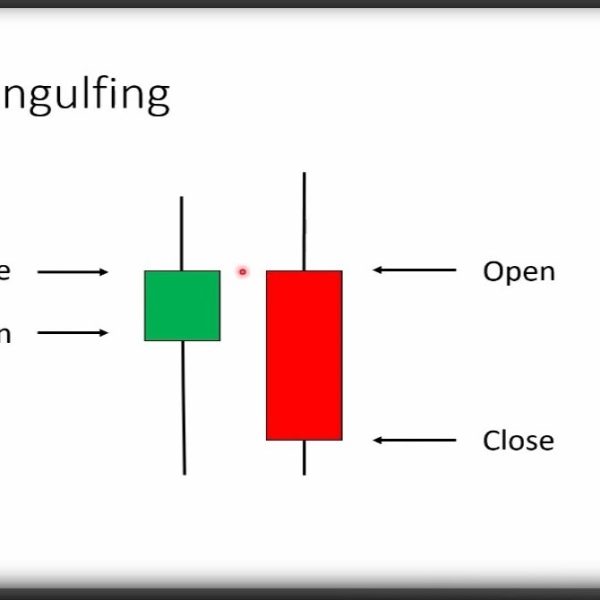

The Mechanics of Buying and Selling Stocks

Investors need to open trading accounts in order to trade stocks. Brokerage firms help investors buy and sell things by carrying out their buy and sell orders. Through online platforms offered by these brokers, investors can easily purchase and sell stocks.

Investors put in orders that say how many shares they want to buy and how much they want to pay for them. Market orders are carried out right away at the current price on the market. Limit orders, on the other hand, let buyers choose the exact price at which they want to buy or sell.

What Supply and Demand Mean in Stock Market

The market prices of stocks are set by the forces of supply and demand. Buyers are willing to pay the most for a stock, which is shown by the bid price. Sellers are willing to take the least, which is shown by the ask price. If a lot of people want to buy a stock, the price will probably go up, and if not, it will likely go down.

In the stock market, supply and demand are affected by a number of things. Stock prices are affected by many things, such as the economy, how well a company is doing, trends in the business, and how investors feel about the company. For investors to make smart financial choices, they need to stay up to date on these issues.

You Have to Know About Market Makers

A big part of making sure the stock market is open and works well is the job of market makers. These people or businesses make it easier to buy and sell shares by constantly posting bid and ask prices for different stocks. Market makers keep the market liquid so that buyers can always buy or sell shares.

Market makers make sure the market is fair and works well by setting prices that are competitive. They also help close the bid-ask spread, which is the space between the price a buyer is willing to pay and the price a seller is willing to take. This makes sure that there aren’t big price differences when buyers trade stocks

Are There Rules in the Stock Market to Protect Investors?

Stock markets are regulated to protect investors and market integrity. The SEC regulates the US stock market. The SEC protects investors from fraud and market manipulation by requiring corporations to disclose accurate and timely information.

Investor confidence and fair and transparent markets depend on regulators like the SEC. Stock exchanges, brokers, and financial advisors are regulated to ensure ethical behaviour and fairness to investors.

Types of Stock Markets

While the term “stock market” is often used broadly, there are various types of financial markets that cater to different securities:

- Over-the-Counter (OTC) Markets: These markets facilitate trading outside of major exchanges. OTC trades are primarily conducted directly between buyers and sellers, and they often involve securities like bonds and penny stocks.

- Commodities Markets: Commodities markets focus on the trading of raw materials such as oil, coal, and steel. These markets enable producers and consumers to hedge against price fluctuations and facilitate global trade.

- Derivatives Markets: Derivatives are financial contracts whose value is derived from an underlying asset. Options and futures are examples of derivatives that allow investors to speculate on the future price movements of stocks or other assets.

- Foreign Exchange Markets: Forex markets facilitate the trading of currencies from different countries. These markets play a pivotal role in international trade and enable investors to profit from fluctuations in currency exchange rates.

- Cryptocurrency Markets: Cryptocurrency exchanges provide a platform for buying and selling digital currencies like Bitcoin and Ethereum. These markets operate independently of traditional financial institutions and are gaining popularity as an alternative investment avenue.

How Can I Invest in the Stock Market?

Investing in the stock market offers individuals the opportunity to grow their wealth over time. Here are the key steps to get started:

- Determine Your Investment Goals: Define your financial objectives, such as saving for retirement, funding education, or achieving specific financial milestones.

- Choose an Investment Account: Select the type of account that aligns with your goals, such as an individual brokerage account, retirement account or education savings account.

- Open a Brokerage Account: Research and select a reputable brokerage firm that offers the services and features you require. Consider factors such as fees, investment options, customer support, and user-friendly platforms.

- Fund Your Account: Deposit funds into your brokerage account to have capital available for investing. You can choose to make a one-time deposit or set up recurring contributions.

- Diversify Your Portfolio: Spread your investments across different asset classes, industries, and geographic regions to minimize risk.

- Conduct Research: Thoroughly analyze potential investments by examining company fundamentals, industry trends, and financial performance. Stay informed about market news and developments that may impact your investments.

- Execute Trades: Place buy or sell orders through your brokerage account’s online platform. Ensure that you understand the order types and their implications before executing trades.

- Monitor and Review: Regularly evaluate the performance of your investments and make adjustments as needed. Stay updated on company news, economic indicators, and market trends that may affect your portfolio.

- Seek Professional Advice: If you feel overwhelmed or lack the time and expertise to manage your investments, consider consulting a financial advisor who can provide personalized guidance.

Also Read: The Dark Side of the Stock Market (Understanding Spoofing and Its Dangers)

In Closing

When it comes to stocks, anyone who wants to spend their money wisely needs to know how the market works. You can feel confident in the market if you know the basics about stock markets, stock platforms, and how to buy and sell stocks. Keep up with the news, spread out your investments, and make sure your investment choices are in line with your financial goals. If you are patient and give it time, the stock market can help you get rich.