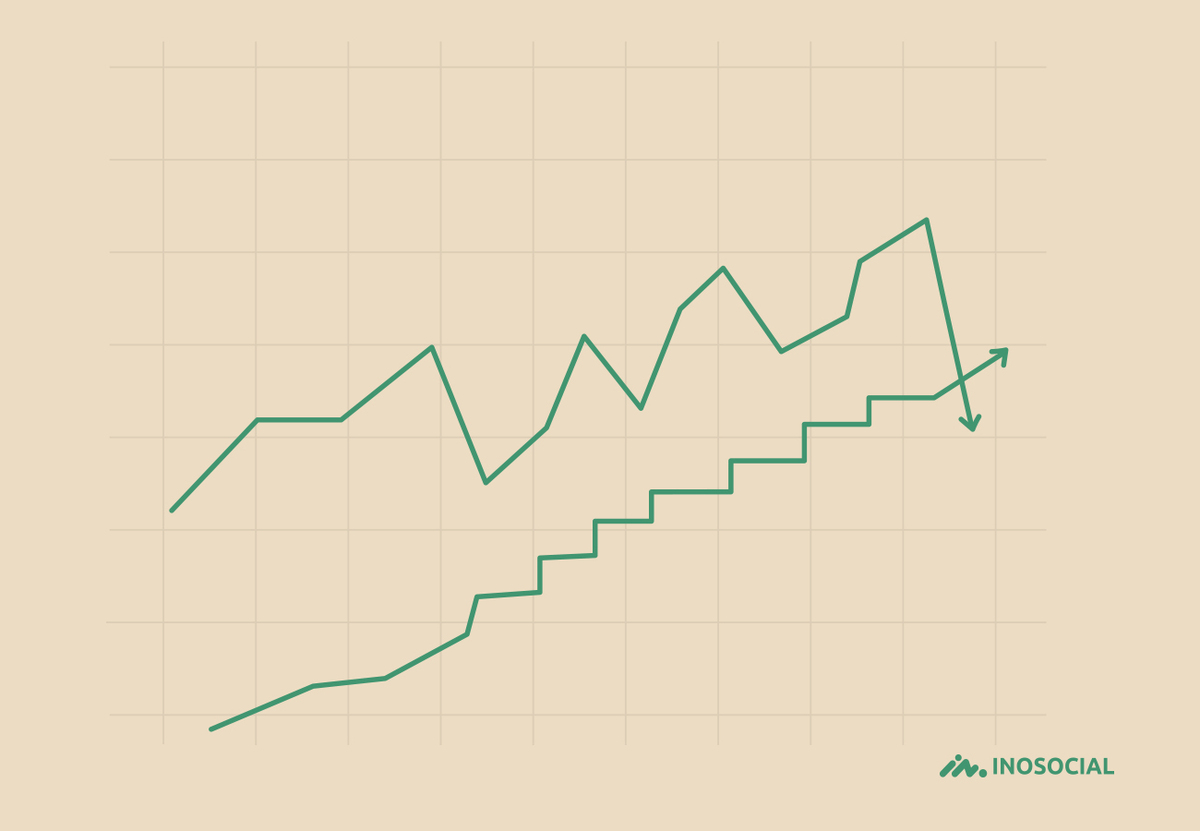

A trailing stop order is a type of order that allows you to automatically protect your profits as the market moves in your favor. It is a dynamic order that “trails” your stop loss price along with the price of the security. As the security price rises, so does the stop loss price.

You can also read: The Merge Ethereum Upgrade: All You Need To Know

What is a trailing stop order?

A trailing stop order is an order to buy or sell an asset at the best market price, but only after the market price has risen to a certain level. The order is placed at a fixed amount below the current market price and will automatically adjust to the market price as it rises.

If you place a trailing stop order for XYZ stock with a 10% trailing stop, your order will activate when the stock hits $90 and will fill at $81 (10% below $90).

How does a trailing stop order work?

As the stock price fluctuates, the stop price moves up or down accordingly, but never goes below the specified percentage. For example, if you place a 25% trailing stop on a stock currently trading at $100, and it rises to $120, your stop price would automatically adjust to $90 (25% below $120). If the stock then fell to $110, your stop would adjust to $82.50 (25% below $110), and so on.

What are the benefits of a trailing stop order?

This type of order is designed to protect investors from downside risk by allowing them to lock in profits as a stock price rises, while still allowing for upside potential.

There are several benefits of using a trailing stop order:

- It can help you lock in profits on a rising stock price, while still allowing for upside potential.

- t can help to minimize losses if the stock price falls suddenly.

- It can take the emotion out of decision-making, as it automatically sells your shares once the stock reaches your predetermined target price.

- Trailing stop orders can be placed with most brokers and are relatively simple to set up.

What are the risks of a trailing stop order?

The first risk is that the trailing stop may not be executed at the desired price if the market moves too quickly. This can result in losses if the market continues to move against the position. Another risk is that a sudden spike in volatility can cause the stop to be triggered and close out the position at a loss. Finally, if there is a gap in prices (such as overnight or during weekends), the stop may not be executed at the desired price, again leading to potential losses.

How to place a trailing stop order?

When you place a trailing stop order, you are essentially setting a stop loss order at a certain percentage below the market price. For example, let’s say you buy shares of Company XYZ at $50 per share. You could place a trailing stop order 10% below the market price, which would protect your downside if the stock price fell to $45 per share.

If the stock price instead rose to $60 per share, your trailing stop order would automatically adjust to 10% below the new market price, or $54 per share. That way, you would still have some upside potential while protecting your original investment.

Trailing stop orders can be placed with most online brokerages and are a helpful tool for investors who want to limit their downside risk while still participating in upward moves in the stock market.

Conclusion

A trailing stop order is a type of order that automatically adjusts the stop price for an open position as the market moves in your favor. This ensures that you lock in your profits as the market moves, and protects you from any sudden reversals. Trailing stop orders are a great way to manage your risks and maximize your profits in volatile markets.