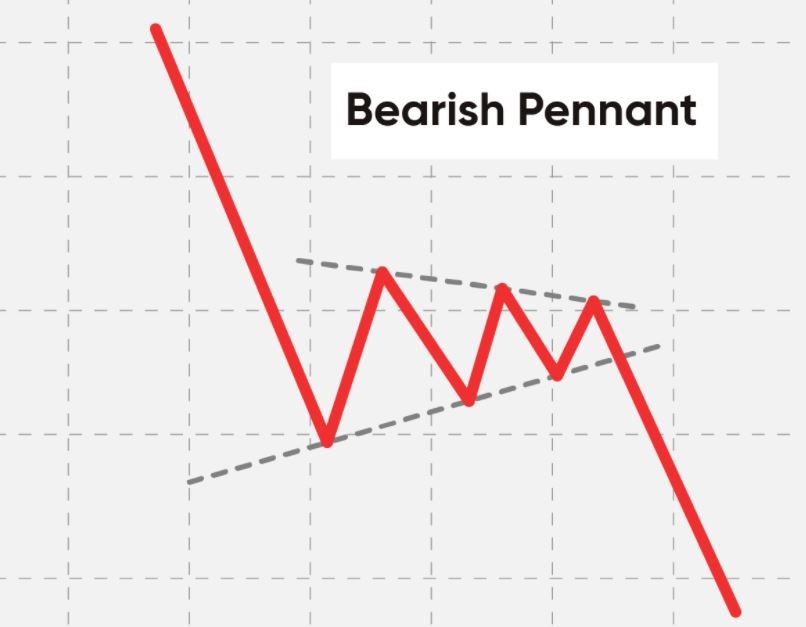

A Bearish Pennant is a specialized investigation design that can assist you with spotting solid downtrends in financial markets. Different brokers appreciate Bearish Pennant patterns since they are not difficult to recognize and, once distinguished, can warn you of long and profound remedies. Accordingly, the example can likewise assist you with spotting misleading bottoms.

You can also read: Equity ETF: The Best Investment For Your Retirement

In this article, we will survey what a Bearish Pennant pattern is, what it resembles and how to affirm the example with pointers. Then, we will audit exhaustively the way in which a dealer sets up their exchange with the risk and take profit levels noted. Finally, the Bearish Pennant pattern is not generally 100 percent exact, so we will survey a portion of its impediments.

This pattern is a diagram exchanging continuation design in which, after a solid move lower, costs stop and solidify momentarily, then, at that point, separate further, continuing the bigger amendment. The example gets its name from the union, which regularly resembles a flag as costs wedge together prior to separating further. The Bearish Pennant pattern is something contrary to the bull flag outline design.

A Bearish pennant is framed when a digital currency falls, yet purchasers trust it is not sufficiently reasonable yet. The purchasers wait and do not buy. The traders who are short become apprehensive and leave the situation by repurchasing it. Subsequently, the asset’s cost expands a little, yet on powerless volume.

After some time, the volume during this solidification period will in general be frail. The asset appears to skip inside a reach, gaining no headway thoughtlessly. After a short period, the buybacks stop and the exchanging volume will in general fall as the last traders are shaken out. Whenever volume blurs, the traders show up once more and keep on pushing the market lower, continuing its downtrend.

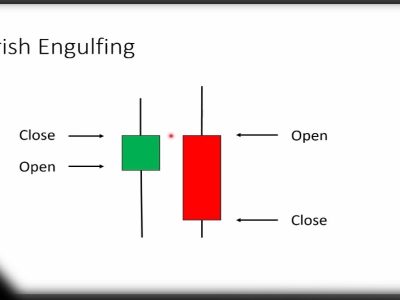

Bearish pennants have a great deal of similarities to a bear pattern in technical analysis. Both patterns are consolidating a downtrend, which then leads to lower prices. The two examples are merging a downtrend, which then prompts a further break lower in cost. Nevertheless, there is a slight distinction in their shape. The Bearish Pennant has a rectangular examination of the solidification stage, while the bearish pennant pattern looks like a triangle.

Trades banter whether the bear pennant or bear pattern is the more impressive example. From one viewpoint, the three-sided state of the bear pattern recommends there are not any purchasers on the lookout, which will in general prompt more limited combination periods. Then again, the rectangular state of the bear pennant is viable at “faking out” possible purchasers, catching them into selling as the downtrend is pumped.

Outstanding attributes of a Bearish Pennant chart pattern

While taking a gander at a Pennant continuation design, you will see the accompanying:

- Pole: A Pennant design generally starts with a flagpole, which separates it from different kinds of examples (like the balanced triangle). The flagpole is the underlying solid move going before the triangle.

- Breakout levels: There will be two breakouts, one toward the finish of the flagpole, and one after the combination period, where the vertical or descending pattern proceeds

- Pennant body: The Pennant is the three-sided design shaped when the market unites, between the flagpole and the breakout. The two combining trendlines structure the triangle – the Pennant.

These qualities should be visible underneath, as for the Bullish Pennant Pattern.

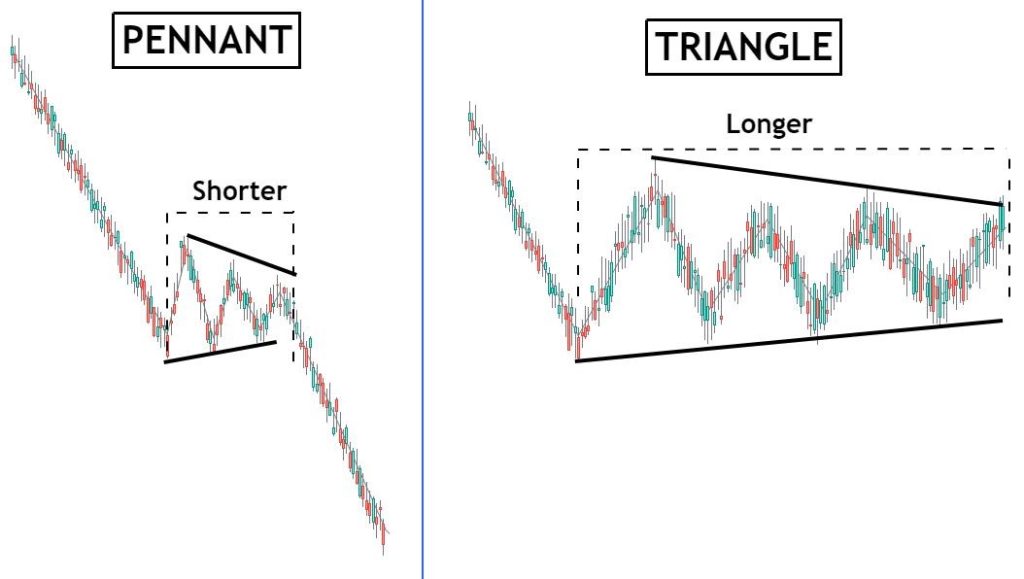

PENNANT PATTERNS vs. TRIANGLE PATTERNS

Flag designs are basically the same as triangle designs, yet there are a few significant contrasts between a Pennant and a triangle that ought to be recognized to effectively exchange either design.

These are the critical contrasts to note:

- A Pennant chart pattern must be gone before by a solid up or down move that looks like a flagpole. On the off chance that there is not a flagpole, then it is a triangle and not a Pennant.

- A Pennant will in general frame a shallow retracement (ordinarily under 38% of the flagpole). A profound retracement is demonstrative of a triangle as opposed to a Pennant.

- A Pennant is portrayed by the continuation of the vertical or descending pattern.

- A Pennant is a momentary example that is generally finished inside one to three weeks. A triangle pattern for the most part takes significantly longer to frame.

Instructions to trade Pennants pattern

While trading, a similar methodology can be applied to both the Bullish and Bearish Pennant patterns. In any case, the Bullish Pennant will have a long predisposition, and the Bearish Pennant, a short inclination.

Brokers ought to hope to enter the trade on the affirmation of the breakout after an abrupt, sharp move in cost. The flag, after a sharp move in cost, shows that there is probably going to be a breakout and continuation toward the underlying move.

A candle close over the flag gives the passage point. In this model, the break was fairly critical and added to the probability of a proceeding move to the potential gain.

A stop misfortune can be put at the low of the breakout flame, seeing that it was a seriously large move or, for more moderate merchants, a stop can be set underneath the flag to restrict disadvantage risk. This normally offers a satisfactory degree of assurance for brokers.

Remember that the market does not necessarily in every case move in the manner in which you expect which is the reason merchants ought to constantly embrace judicious threats from the board. To represent this, just at any point exchange with capital that you can stand to lose.

To set target levels, traders can quantify the separation from the start of the flagpole up to the Pennant, and then copy this separation from the cost breakout following the Pennant.

Confirmation of a Bearish Pennant by indicators

The best pointers to affirm a bear pattern are its shape, as well as where the example structures inside the past downtrend. There are a few extra markers that can be utilized to assist with affirming the bear flag; however, those signs may not be the most dependable. A right Bearish Pennant example ought to have a contracting triangle shape instead of a square shape.

Shape and Location

We recently talked about how the state of the bearish pattern should be a triangle at the lower part of a stick. The triangle piece of this example needs to show up in the lower half of the stick, in all likelihood inside the lower third of it. The length of the triangle will be brief, as the market is preparing to dump in a more profound adjustment.

Volume

Volume can give a major sign about the legitimacy of the Bearish Pennant pattern. Normally, the underlying decay happens on a ton of exchanging volume. Then, at that point, as the digital currency solidifies during the triangle flag piece of the example, the volume will fall as the two purchasers and traders stand to the side.

As the triangle breaks, volume will in general get again as the market remedies towards much lower levels. Keep in mind, patterns will generally follow volume. Along these lines, a solidification on debilitating volume proposes the meeting is reasonably transitory and will be much backtracked.

Pros and cons of the Bearish Pennant Pattern

Seemingly, the greatest strength of this pattern is that it assists brokers with distinguishing the stage at which the pattern is presently in. Hence, the flag makes life more straightforward for merchants, as it furnishes them with definitively characterized exchanging levels, because of the flagpole and flag.

A development that actually looks at every one of the three boxes (flagpole, a flag, and a breakout) with an amendment finishing at around 38.2% is a reading material Bearish Pennant pattern. The more limited and milder the adjustment, the more grounded the downtrend and a definitive breakout generally is.

Flags share similar shortcomings with pennants – the drawn-out union stage can bring about an inversion design. Therefore, it is significant not to enter the exchange before the breakout happens and to continuously counsel other specialized pointers in affirming the breakout.

A viable flag can warn you of a strong pattern with a decent R/R (risk to reward) proportion trade. Nevertheless, not all of these patterns are 100 percent precise.

The more the triangle consolidation phase prolongs, the lesser the possibility of a continuation lower becomes. This means that the likelihood of an outright reversal increases, which can frustrate bearish bias.

One method for staying away from this disappointment is to hang tight for a breakdown beneath the lows of the triangle, instead of attempting to time a short sell passage at the triangle’s high.

One more impediment of the Bearish Pennant pattern is that assuming you follow it on a brief diagram, the information rolling in from other affirming pointers might be defective. There basically is not an adequate number of information taking care of into the volume or ATR indicator to deliver clear signals. Thus, a more modest graph time frame may not show affirmation of the example, regardless of whether it in the end works out.

To summarize

In a Bearish pennant pattern, solid negative bias makes a market dive lower and shapes the pole of the pattern. The sellers who have pushed its value down could then ease off and take profit, while bulls sense the potential for a quick return.

Like the bullish pennants, this brings about consolidation in the market. However, this consolidation cannot endure forever. Without enough bullish bias to recuperate, the market turns down again. When it moves outside of its support, any sellers who have been keeping down hop on – sending it to new lows.

Assessing bearish and bullish pennants can be difficult at first as the consolidation is sometimes small when compared to the preceding price move.

FAQs

How long does a bearish pennant endure?

The bearish pennant is viewed as a transient example that structures over a time of days or potentially weeks. In a perfect world, a bearish pennant pattern endures somewhere in the range of one week and a month.

What do pennants resemble?

A flag is a little symmetrical triangle that starts wide and combines as the pattern develops and slope is normally neutral.