Candlestick patterns have been used by traders for centuries as a tool to analyze and predict market movements. These patterns, formed by the open, high, low, and close prices of an asset, provide valuable insights into the psychology of market participants. One such candlestick pattern is the bullish engulfing pattern. This article will explore what a bullish engulfing candle is, and how to use it in trading.

What is a Bullish Engulfing Candle?

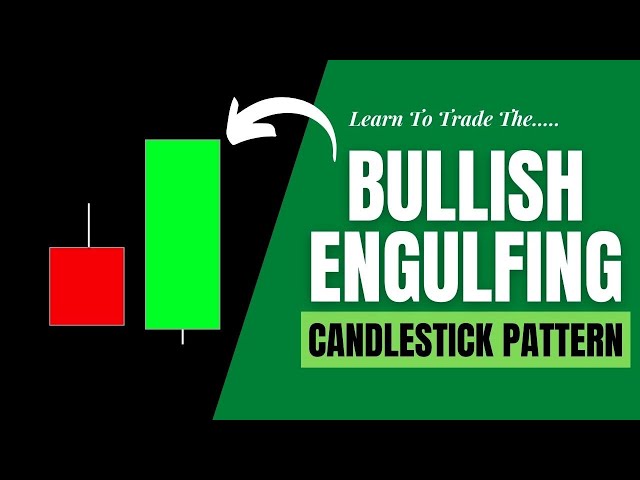

A bullish engulfing candle is a two-candle pattern that occurs during a downtrend and signals a potential reversal in the market. The first candle in the pattern is a bearish candle, indicating selling pressure. The second candle, however, is a larger bullish candle that completely engulfs the previous bearish candle, suggesting a shift in sentiment toward buying pressure. This pattern is considered a strong bullish signal, especially when it forms at key support levels or after a prolonged downtrend.

Traders look for specific criteria to confirm the validity of a bullish engulfing candle. Firstly, the body of the second candle must be larger than the body of the first candle. Secondly, the wicks of the second candle should be relatively small compared to the overall size of the candle. Lastly, the bullish engulfing candle should have a higher trading volume than the previous bearish candle, indicating increased buying interest.

How to Use the Bullish Engulfing Candle Pattern in Trading

The bullish engulfing candle pattern can be a powerful tool in a trader’s side if used correctly. When this pattern forms, it suggests that buyers are taking control and that a reversal may be imminent. Traders often use the following strategies when incorporating bullish engulfing candles into their trading decisions:

- Confirmation through other indicators: While a bullish engulfing candle can be a strong signal on its own, it is often beneficial to confirm the pattern with other technical indicators. This can include trendlines, moving averages, or oscillators. By combining multiple indicators, traders can increase the probability of a successful trade.

- Entry and exit points: Traders may use the bullish engulfing candle pattern to determine their entry and exit points. For example, a trader may enter a long position when the bullish engulfing candle forms, placing a stop-loss order below the low of the pattern. They may then exit the trade when the price reaches a predetermined target or when a bearish reversal pattern forms.

- Risk management: As with any trading strategy, risk management is crucial. Traders should always determine their risk-reward ratio before entering a trade based on the bullish engulfing candle pattern. This involves setting a stop-loss order to limit potential losses and identifying a profit target that offers a favorable risk-reward ratio.

Avoid These Bullish Engulfing Candle Trading Mistakes

While the bullish engulfing candle pattern can be a powerful tool, it is important to avoid common mistakes that can lead to poor trading decisions. Here are some mistakes to watch out for:

- Ignoring the overall market context: Failing to consider the overall market context can lead to false signals and missed opportunities. Always analyze the trend, volume, and key support/resistance levels before making trading decisions based on the bullish engulfing candle pattern.

- Overtrading: Trading every bullish engulfing candle you see can lead to overtrading, which increases the risk of losses. Instead, focus on high-probability setups that align with your trading strategy and risk tolerance.

- Neglecting risk management: Neglecting risk management is a common mistake that can have detrimental effects on your trading account. Always set stop-loss orders and take-profit levels based on your risk-reward ratio to protect your capital.

Effective Bullish Engulfing Candle Pattern Tips

The bullish engulfing candle pattern can help traders, but they must apply it properly. Consider these tips:

- Combine with other technical analysis tools: To maximize the odds of a successful trade, combine the bullish engulfing candle pattern with trendlines, support and resistance levels, or oscillators. You may confirm and improve your trading selections using this.

- Consider the market background: The bullish engulfing candle pattern should be considered in context. Trend, volume, and major support/resistance levels must be considered in the market environment. This can help you avoid false signals and make better trading selections.

- Practice risk management: Risk management is essential with any trading method, including the bullish engulfing candle pattern. Set stop-loss orders and take profits at specified levels to protect your winnings. Before trading, check the risk-reward ratio to make sure it fits your strategy.

In Closing

Traders who want to find possible market turns can use the bullish bursting candle pattern very effectively. But it’s important to keep in mind that there is no such thing as a perfect trading strategy. Managing risk should always be your top goal. As a trader gets better at what they do, the bullish bursting candle pattern can become very useful. So, keep studying, practicing, and refining your trading skills to make the most of this versatile pattern.