It’s when investors who have shorted a stock scramble to buy shares to cover their positions, causing a sudden surge in demand and driving up the price. But what does this have to do with sellers quitting? Well, if you’re someone who likes to sell stocks short, facing a short squeeze can be an incredibly stressful and risky situation – one that might make you think twice about your trading strategy altogether. In this blog post, we’ll explore the connection between short squeezes and quitting for sellers, offering insights into how these market phenomena can impact traders’ decisions and what steps they can take to mitigate risk. So buckle up and let’s dive into the exciting world of stock market trading!

You can also read about The Dow Theory

What is a Short Squeeze?

In order to understand what a short squeeze is, we need to first understand what shorting is. Shorting is when an investor borrows shares of a stock that they believe will go down in price, and then sells those shares. If the price of the stock does fall, the investor buys back the shares at a lower price and returns them to the person they borrowed them from, pocketing the difference as profit.

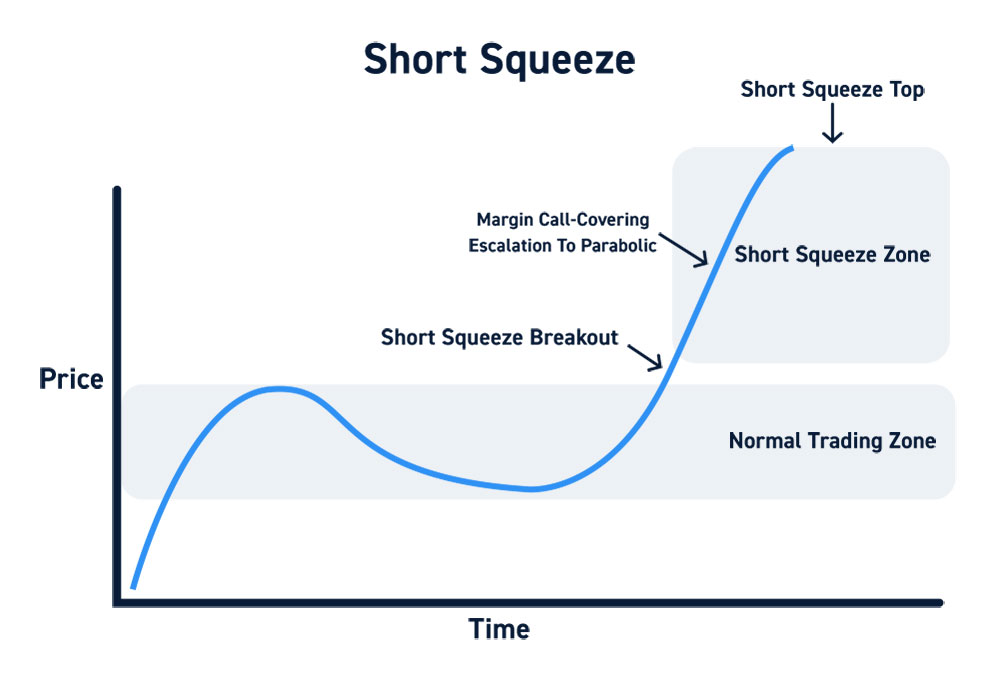

However, if the price of the stock unexpectedly goes up instead of down, the investor is forced to buy back the shares at a higher price than they sold them for, resulting in a loss. This scenario is known as a “short squeeze.”

Short squeezes can be caused by many things, but one of the most common reasons is that investors who are shorting a stock start to panic when they see the price rising. As more and more investors try to buy back their shares (to avoid even bigger losses), this causes the price to go up even further, creating a self-fulfilling Prophecy.

Other times, companies or investors with a lot of cash may deliberately start buying up shares of a stock that they know shorts are trying to drive down. This forces shorts to buy back their shares at an even higher price, again leading to profits for those with long positions.

How Does Short Squeezing Effect Sellers?

Short squeezes can have a profound effect on sellers, causing them to quit their positions or close out their orders. When a short squeeze occurs, prices rapidly increase as buyers purchase stock and cover their short positions. This puts pressure on sellers, who may be forced to sell at a loss or accept a lower price than they had hoped for. In some cases, the price increase can be so rapid that it causes a panic among sellers, leading to mass selling and further price declines.

How to Spot and Avoid Short Squeezes?

When a stock price starts to increase rapidly, short sellers may start to “squeeze” the price by buying the stock, which in turn pushes the price up even more. This can be a vicious cycle that drives the price of the stock up very quickly.

As a seller, you need to be aware of this phenomenon so that you don’t get caught in a short squeeze. There are a few things you can look for to spot a short squeeze:

- A rapid increase in the stock price

- Heavy volume trading

- A decrease in the number of shares available for borrowing

If you see these signs, it’s important to be patient and wait for the short squeeze to die down before selling your shares. If you sell too early, you may end up selling at a much lower price than you could have gotten if you waited it out.

Benefits of Short Squeezing for Buyers

When a stock price is rising quickly, short sellers are forced to buy shares to cover their positions, driving the price up even more. This phenomenon is known as a short squeeze, and it can be a great opportunity for buyers.

Short squeezes often happen when there is positive news about a company, such as an earnings beat or an analyst upgrade. The stock price starts to rise, and the short sellers start to get nervous. They start buying shares to cover their positions, which drives the price up even more.

The benefits of a short squeeze for buyers are twofold. First, they can make money if they buy shares before the squeeze happens and sell them after the price has risen. Second, they can use the squeeze as an opportunity to buy shares at a discount. Short squeezes don’t last forever, so if you’re patient, you may be able to get a good deal on shares that will eventually go up in value.

Dangers of Short Squeezing for Sellers

There are a few dangers of short squeezes for sellers that should be considered before taking any action. First, if a stock is subject to a short squeeze, the price may increase very quickly and significantly. This could lead to losses for the seller if they are not able to sell their position before the price starts to drop again. Second, if there is a significant short squeeze, it could trigger a margin call from the broker. This means that the seller would have to deposit more money into their account or close out their position entirely. If there is a lot of buying pressure in the market, it could lead to a sharp increase in price followed by a sudden crash. This could result in substantial losses for the seller.

Conclusion

In conclusion, short squeezes can create a very difficult situation for sellers. As prices continue to rise due to the buying pressure of investors’ purchases, it becomes more and more expensive for sellers to cover their positions and they can find themselves stuck in an untenable position. Understanding how short squeezes work and being aware of the risks associated with them is essential for any seller who wants to make sure that they don’t end up getting caught out when the market turns against them.