Cryptocurrencies have become increasingly popular in recent years, and as a result, many different wallets have been created to store and manage these digital assets. Two of the most popular wallets are Trust Wallet and Metamask. Trust Wallet is a mobile wallet that allows users to store a wide variety of cryptocurrencies on their smartphones. On the other hand, Metamask is a browser extension wallet that can be used with desktop browsers. In this article, we will explore how to connect Trust Wallet to Metamask Wallet.

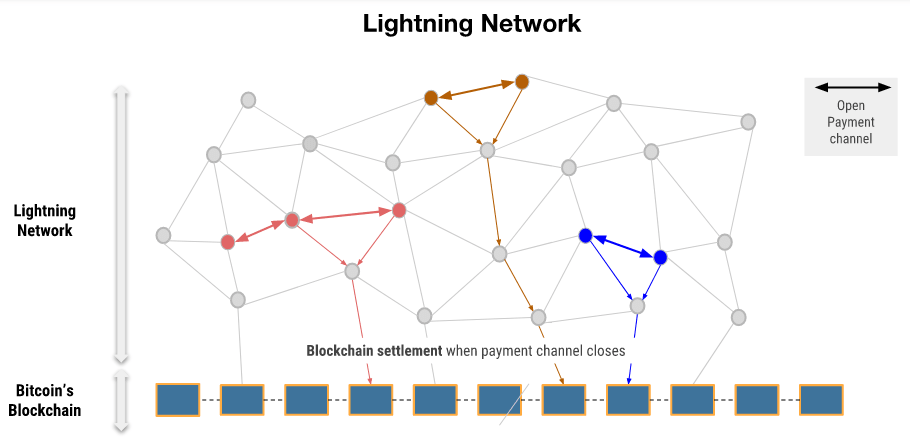

You can also read: What Is Lightning Network?

What is Trust Wallet?

Trust Wallet is a mobile cryptocurrency wallet that allows users to securely store, manage, and transact with their digital assets. It was founded in 2017 by Viktor Radchenko and later acquired by Binance, one of the largest cryptocurrency exchanges in the world. Trust Wallet is available for free on both iOS and Android devices.

Trust Wallet is a non-custodial wallet, which means that users have full control over their private keys and funds. It supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Binance Coin, and many others. Users can also store and manage non-fungible tokens (NFTs) and other digital assets on the wallet.

One of the key features of Trust Wallet is its ease of use. The wallet has a simple and intuitive interface that makes it easy for users to manage their digital assets. It also provides users with quick access to popular decentralized applications (dApps) on the Ethereum blockchain, allowing them to easily interact with the decentralized web.

Trust Wallet also offers a range of security features to ensure the safety of user funds. It uses industry-standard encryption to secure user data and private keys and also supports biometric authentication for added security. Additionally, Trust Wallet allows users to set up a recovery phrase, which can be used to restore access to their wallet if they lose their device or forget their password.

What is Metamask?

Metamask is a popular browser extension wallet that allows users to store, manage and interact with decentralized applications (dApps) on the Ethereum blockchain. It is a non-custodial wallet, which means that users have complete control over their private keys and funds. Metamask is available as a free extension for Google Chrome, Mozilla Firefox, Opera, and Brave browsers.

Metamask provides users with a simple and secure way to interact with Ethereum-based dApps and smart contracts directly from their browsers. It also supports multiple networks, including Ethereum, Binance Smart Chain, and more. Users can easily switch between networks and manage their assets across different blockchains.

In addition to its wallet functionality, Metamask also provides users with a built-in decentralized exchange (DEX) called Metamask Swap, which allows users to easily swap one cryptocurrency for another without leaving the wallet interface. Overall, Metamask is a versatile and user-friendly wallet that has become an essential tool for many Ethereum users.

Metamask is a highly versatile wallet that provides users with many features and benefits. Here are some additional details about Metamask:

- Seamless Integration: Metamask integrates seamlessly with popular web browsers, making it easy for users to access their wallets and interact with dApps directly from their browsers.

- Easy-to-Use Interface: Metamask has a simple and user-friendly interface that makes it easy for users to manage their assets and interact with dApps without needing to understand the technical details of the underlying blockchain technology.

- Multiple Network Support: Metamask supports multiple networks, including Ethereum, Binance Smart Chain, and more. This means that users can easily manage their assets across different blockchains.

- Non-Custodial Wallet: Metamask is a non-custodial wallet, which means that users have complete control over their private keys and funds. This provides users with a high level of security and privacy.

- Decentralized Exchange: Metamask has a built-in decentralized exchange called Metamask Swap, which allows users to easily trade one cryptocurrency for another without leaving the wallet interface.

- Secure Transactions: Metamask transactions are secured by a password or biometric authentication, adding an extra layer of security to user funds.

- Customizable Network Fees: Metamask allows users to customize their network fees, giving them control over the speed and cost of their transactions.

How to Connect Trust Wallet to Metamask?

Connecting Trust Wallet to Metamask is a straightforward process that can be completed in a few simple steps. Here’s how to do it:

Step 1: Back up Your Data in Trust Wallet

Before you start connecting your Trust Wallet to Metamask, it’s essential to back up your data. It ensures that you have a secure backup of your Trust Wallet account and its private key. To do this, follow these steps:

- Open your Trust Wallet app and tap on the three horizontal lines at the top right corner.

- Select “Settings” and then “Wallets.”

- Tap on the wallet you want to back up and select “Backup.”

- Follow the instructions to back up your data securely.

Step 2: Install the MetaMask Browser Extension

To connect your Trust Wallet to Metamask, you need to install the Metamask browser extension. Here’s how you can do it:

- Open your browser and go to the Metamask website.

- Click on the “Get Chrome Extension” button and add it to your browser.

- Follow the instructions to install the extension.

Step 3: Import Your Account from TrustWallet to Metamask

Once you have backed up your data in Trust Wallet and installed the Metamask browser extension, you can import your Trust Wallet account to Metamask. Here’s how:

- Open the Metamask browser extension by clicking on the fox icon in your browser’s toolbar.

- Click on the three dots in the top right corner and select “Import Account.”

- Select “Import using seed phrase” and enter the 12-word seed phrase you backed up from your Trust Wallet.

- Follow the instructions to complete the import process.

Step 4: Send Cryptocurrency from Trust Wallet to Metamask

In Trust Wallet, click on the “Send” button and enter the amount of cryptocurrency you want to transfer to Metamask. In the “To” field, enter the address of your Metamask wallet. You can find this address by clicking on the Metamask extension in your browser and selecting the “Account Details” option.

Make sure to double-check the recipient address to ensure that you are sending the cryptocurrency to the correct wallet.

Step 5: Confirm the Transaction

Before sending the transaction, make sure to review the details and confirm that everything is correct. This includes the recipient’s address, the amount being sent, and the gas fee (transaction fee). Once you’re sure everything is correct, confirm the transaction in Trust Wallet.

The transaction will then be broadcast to the network and will need to be confirmed by miners. This can take a few minutes, depending on network congestion and other factors.

Step 6: Check Your Metamask Wallet

Once the transaction is confirmed, you should be able to see the transferred funds in your Metamask wallet. To check this, open the Metamask extension in your browser and go to the “Assets” tab. You should see the transferred cryptocurrency listed with the correct amount.

If you don’t see the transferred funds in your Metamask wallet, you can try refreshing the page or checking your transaction history to see if there were any errors or delays.

That’s it! You have successfully connected your Trust Wallet to Metamask and transferred cryptocurrency between the two wallets. Remember to always double-check the recipient’s address and transaction details before sending any cryptocurrency to ensure that it reaches the correct wallet and amount.

Prior to these steps, you should:

Install and Set Up Trust Wallet

If you don’t have Trust Wallet installed on your mobile device, you can download it from the App Store (for iOS) or Google Play Store (for Android). Once downloaded, open the app and follow the prompts to create a new wallet or import an existing one. Make sure you keep your recovery phrase safe, as this is needed to restore your wallet if you lose access to your device.

Install and Set Up Metamask

If you don’t have Metamask installed on your desktop browser, you can download it from the Metamask account website. Follow the prompts to create a new wallet or import an existing one. Make sure you keep your seed phrase safe, as this is needed to restore your wallet if you lose access to your browser.

Add the Same Network to Both Wallets

In order for Trust Wallet and Metamask to communicate with each other, they must be using the same network. To do this, open Trust Wallet and select the cryptocurrency you want to transfer to Metamask. Then, click on the “Settings” icon in the top right corner of the screen and select “Networks”. Choose the same network as your Metamask wallet and make sure it is activated.

Next, open your Metamask account and click on the network dropdown menu in the top left corner of the screen. Choose the same network as your Trust Wallet and make sure it is activated.

Note that both wallets support multiple networks, so it’s important to select the same network in both wallets for the transfer to work correctly.

You can also read: Crypto Cold Wallets

In Conclusion

Connecting your Trust Wallet to your Metamask wallet is a simple process that allows you to manage your cryptocurrencies more efficiently. With these two wallets, you can access your digital assets on both your mobile device and desktop browser. By following the steps outlined in this article, you can easily transfer your funds from Trust Wallet to Metamask and take advantage of the benefits of both wallets.

If you’re someone who frequently uses cryptocurrencies, you might have heard about Trust Wallet and Metamask. Both are popular digital wallets that allow you to store, manage and trade various cryptocurrencies. Trust Wallet is a mobile wallet that supports various cryptocurrencies and is widely used on smartphones, while Metamask is a browser extension that is commonly used on desktops. In this article, we will guide you on how to connect Trust Wallet to your Metamask account.